Lenovo has started raising prices on some of its personal computers and says costs are not likely to fall soon. The warning came during the company’s latest quarterly earnings call, first reported by Bloomberg. Company executives said memory prices have increased again and supply remains tight.

Lenovo reported revenue growth of about 7 percent year over year in its fiscal third quarter of FY2026. The company said sales were helped by stronger enterprise demand and growing interest in AI-capable systems. At the same time, executives explained that memory costs have risen enough to affect profit margins. To protect margins, Lenovo has started adjusting PC prices.

The company did not share exact percentage increases by product line or region. It also did not say which models are seeing the largest changes. However, leadership made it clear that higher input costs are driving the decision.

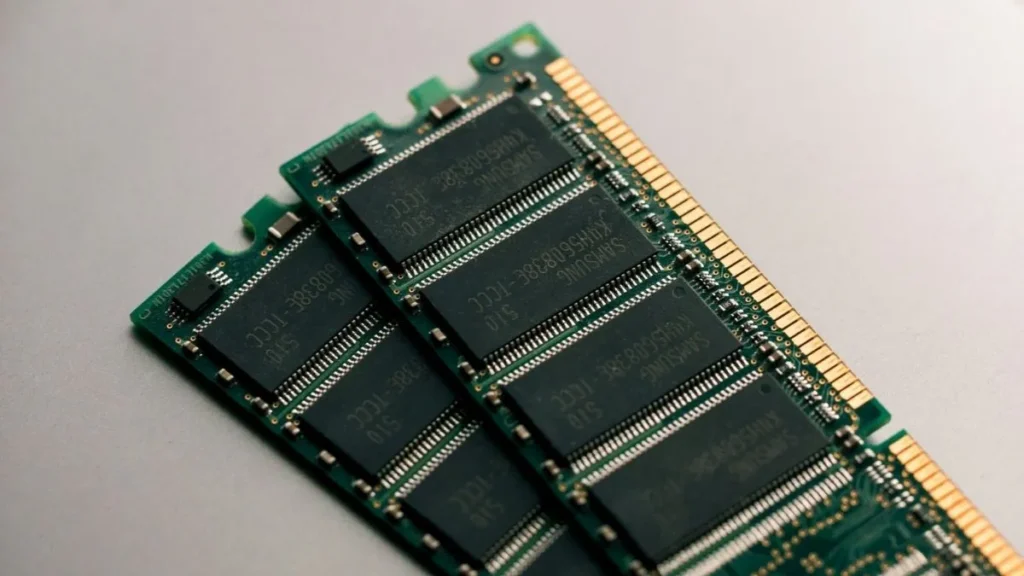

Memory is a key part of every PC. It includes DRAM, which acts as system memory, and NAND flash, which is used for storage. DRAM prices are known to change quickly. When prices rise sharply, PC makers must either accept lower profit or increase prices.

How Memory Affects PC Costs

| Component Category | Approximate Share of Total Cost | Pricing Stability |

|---|---|---|

| CPU or SoC | High | Moderate |

| DRAM (System RAM) | 15% to 25% | Very Volatile |

| NAND Storage | 10% to 20% | Volatile |

| Display | 10% to 15% | Moderate |

| Motherboard and Other Parts | Moderate | More Stable |

If DRAM contract prices increase by 10% to 20% in a quarter, overall system costs rise quickly. Large PC makers like Lenovo usually buy memory through quarterly contracts with suppliers. If contract pricing resets at a higher level, those costs remain elevated for the full contract period.

Industry analysts have noted that memory prices are rising again in 2026 after falling during 2023 and 2024. The earlier period was marked by oversupply and heavy discounting. The current situation is different because of AI demand.

Also Read: PC Price Hikes Incoming PowerGPU Cites Rising SSD and Memory Costs

AI data centers use high-bandwidth memory, also known as HBM. This type of memory works with advanced AI accelerators. Major cloud companies such as Microsoft, Amazon, and Google are investing heavily in AI infrastructure. HBM products bring higher profit margins for memory manufacturers compared to standard DDR5 memory used in PCs. As a result, manufacturers are directing more production capacity toward HBM.

This shift reduces the supply available for traditional PC memory. At the same time, advanced DRAM production nodes, often called 1 beta and 1 gamma, are still ramping up. When production yields are not fully optimized, overall supply can tighten further.

Market Comparison: Then vs Now

| Period | Main Demand Driver | Memory Price Direction | PC Pricing Trend |

|---|---|---|---|

| 2023–2024 | Weak consumer demand | Falling | Heavy discounts |

| 2026 | AI infrastructure growth | Rising | Price increases and margin protection |

In earlier cycles, consumer PCs and smartphones drove demand swings. Now, hyperscale AI operators sign large supply contracts in advance. That makes supply less flexible for other buyers and keeps prices firm.

Lenovo did not provide detailed regional pricing data during its earnings call. However, the company said enterprise demand remains solid. If memory costs stay high through the first half of 2026, price adjustments could continue across notebooks and desktops.

Expected Impact on Buyers

| Buyer Segment | Expected Impact | Key Concern |

|---|---|---|

| Enterprise IT | High | Budget planning and refresh timing |

| Power Users and Creators | High | Ensuring enough RAM for heavy workloads |

| Mainstream Consumers | Moderate | Comparing base memory options carefully |

| Entry-Level Buyers | Low to Moderate | Possible lower default RAM configurations |

Modern operating systems, web browsers, and AI-assisted tools require more memory than older software. A system with 8GB of RAM may struggle with multitasking compared to one with 16GB. Buyers should check memory configurations carefully before purchasing.

Lenovo has not provided a clear timeline for when pricing pressure may ease. It has not disclosed exact percentage increases by product, nor has it said how long current conditions will last. The duration will depend on several factors, including how quickly advanced DRAM production improves and whether AI infrastructure demand slows.

Memory markets move in cycles, but the current environment shows a structural shift. AI infrastructure has become a major force in memory allocation. That changes the balance of power between suppliers and PC makers.

Lenovo’s decision signals that the PC market is entering a tighter cost phase. If AI-driven demand continues and supply remains constrained, higher PC pricing could persist through much of 2026. Buyers expecting a quick return to heavy discounts may need to adjust their expectations as the industry adapts to new demand patterns.

Source: Money Control