A retail DDR5 memory kit built with Chinese-made CXMT DRAM chips has delivered gaming performance comparable to established brands, according to independent testing, adding a new variable to a DRAM market still adjusting to elevated pricing and AI-driven supply shifts.

The kit in question is a 32GB (2x16GB) DDR5-6000 CL36 configuration sold under the KingBank brand in Australia. Independent testing by Hardware Unboxed examined whether modules using ChangXin Memory Technologies (CXMT) integrated circuits introduce compatibility, stability, or gaming performance drawbacks on a modern AMD AM5 platform.

The kit performs as expected, with no gaming disadvantage compared to premium alternatives at the same speed tier.

The CXMT-based KingBank kit is listed at approximately 599 AUD in the Australian market, which converts to roughly 390 USD at current exchange rates. Comparable DDR5-6000 alternatives are priced around 649 AUD, or approximately 420 USD. That represents a difference of about 30 USD, or roughly 7 to 8 percent.

In isolation, the discount is not aggressive. However, in a memory segment where margins are thin and brand premiums often influence buying decisions, even single-digit percentage differences can affect system builders and cost-sensitive gamers. If pricing converges with tighter-timing CL30 Hynix-based kits at similar levels, the value proposition weakens. But where a consistent price gap exists, the CXMT option becomes harder to ignore.

Testing was performed using AMD’s Ryzen 7 9800X3D and Ryzen 7 9700X processors to capture both cache-heavy and more memory-sensitive gaming behavior. Across the titles measured, the DDR5-6000 CL36 kit delivered results broadly in line with a premium G.Skill DDR5-6000 configuration and compared favorably against entry-level DDR5-5200 memory. No compatibility issues were observed, and no instability was reported under rated EXPO settings.

These findings reinforce what has become widely accepted among AM5 users: DDR5-6000 remains the practical performance sweet spot for Ryzen platforms. While tighter timings, such as CL30, can deliver incremental gains in select memory-sensitive workloads or 1 percent low frame rates, real-world gaming deltas between CL36 and lower-latency bins often narrow at the same frequency tier. In that context, matching premium kits at DDR5-6000 removes one of the primary barriers facing alternative DRAM IC suppliers.

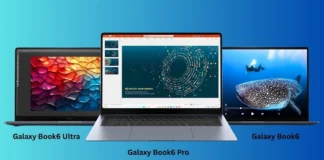

Also Read: Best Laptops with 16GB RAM

The review acknowledged important limitations. X3D processors are generally less sensitive to memory tuning than non-X3D variants. As a result, the data functions more as a confirmation of correct operation than a full exploration of memory scaling behavior.

Overclocking beyond rated speeds was not tested, leaving open questions about headroom beyond DDR5-6000, subtiming flexibility, binning quality, and long-term voltage tolerance. For enthusiasts who push memory beyond EXPO presets, those factors remain relevant.

The broader significance extends beyond a single 32GB kit. The global DRAM market has long been dominated by Samsung, SK hynix, and Micron.

Over the past year, wafer allocation has increasingly prioritized high-bandwidth memory used in AI accelerators, tightening supply in certain consumer segments and contributing to pricing volatility. Smaller module brands have explored alternative DRAM sources to mitigate dependency risks and improve negotiating leverage.

CXMT’s presence in retail DDR5 does not yet represent a structural change in global market share. However, successful validation in mainstream gaming systems reduces technical skepticism. If production scales and pricing pressure increases, even incremental competition can alter supplier negotiations across the ecosystem. Testing shows the CXMT kit runs just as fast in games at DDR5-6000 speeds. There was no stability issue and no frame rate drop.

Reliability remains a longer-term variable. Module branding and chip fabrication are separate layers of responsibility, and warranty support typically flows through the retail brand rather than the DRAM manufacturer itself. As CXMT-equipped kits expand into additional regions and platforms, broader validation data and return rates will provide clearer signals about durability and consistency.

From a consumer perspective, the calculation is straightforward. If the CXMT-based DDR5-6000 CL36 kit is meaningfully cheaper at checkout, current testing shows no gaming disadvantage at rated speeds. If price differences narrow or disappear, buyers may continue favoring tighter-timing or established-brand alternatives.

The immediate impact is modest. The strategic implication is larger. A fourth viable DRAM supplier entering visible retail channels introduces incremental competitive pressure into a highly concentrated industry. In cyclical markets, even small shifts in supply dynamics can influence pricing over time.

Chinese-made CXMT DDR5 has crossed a meaningful threshold: it operates as expected in modern gaming systems at mainstream DDR5-6000 speeds. The discount is measurable but not dramatic.

The performance parity is clear. The long-term pricing impact remains uncertain. Whether that leverage translates into sustained price pressure will depend on production scale, regional distribution, and how aggressively CXMT chooses to compete in the global DDR5 market.

Key Specifications

| Brand | KingBank |

| DRAM Supplier (Some Units) | CXMT (ChangXin Memory Technologies) |

| Capacity | 32GB (2x16GB) |

| Speed | DDR5-6000 |

| Timings | CL36 |

| Profile | AMD EXPO |

| Platform Tested | AMD AM5 |

| CPUs Used | Ryzen 7 9800X3D, Ryzen 7 9700X |

| Price (Approx.) | ~$390 USD |

| Comparable Alternative | ~$420 USD |

Source: Hardware Unboxed(YouTube)