NVIDIA is internally reviewing whether it can expand production of its H200 artificial intelligence GPU following a sharp increase in interest from Chinese technology companies, people familiar with the matter said.

This review comes shortly after the US government confirmed that exports of Hopper-based H200 chips to China will be permitted under a licensing framework that includes a 25 percent tax on sales.

This decision places NVIDIA at the center of a complex supply and policy equation, as Chinese demand for high-performance AI hardware grows while access to cutting-edge accelerators remains tightly controlled.

China Turns to H200 as Options Run Short

For Chinese cloud providers and large technology companies, the H200 is currently the most capable NVIDIA processor they can legally obtain.

Industry sources say interest surged immediately after Washington clarified its export stance, prompting many companies to explore whether large-scale purchases would be possible once regulatory hurdles are cleared.

Alibaba and ByteDance are among the companies that have contacted NVIDIA to discuss potential orders, indicating strong demand in cloud, AI training, and enterprise workloads. However, available supply remains limited, creating uncertainty about timelines and volumes.

Production Priorities Create a Bottleneck

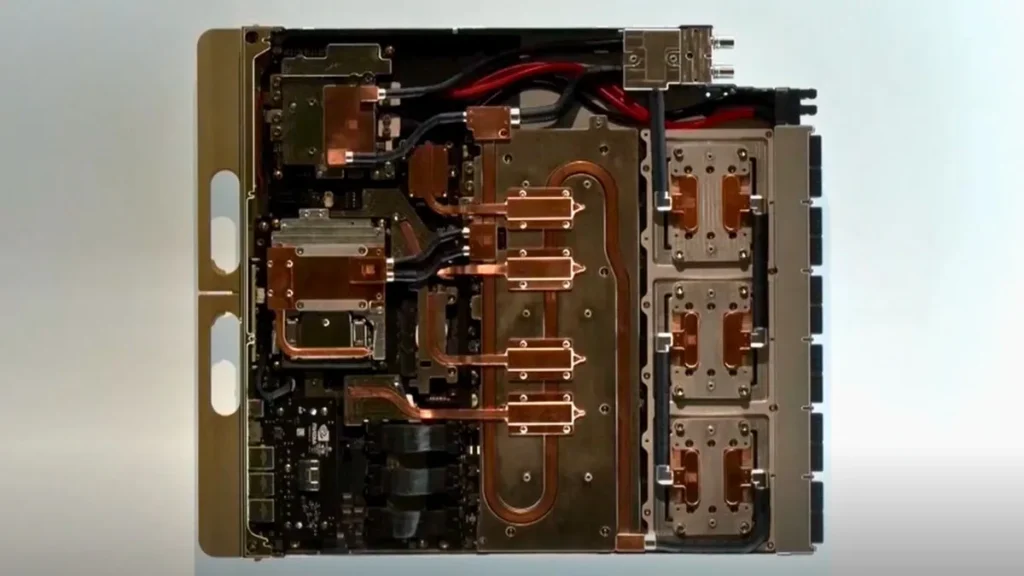

Any increase in H200 output will come with challenges. NVIDIA’s manufacturing capacity is already heavily committed to its next-generation Blackwell GPUs, and the Rubin platform is also nearing production. As a result, H200 volumes are limited, and careful coordination with partners will be required to redistribute capacity.

An NVIDIA spokesperson stated that the company is managing its supply chain to ensure that licensed H200 shipments to China do not disrupt availability for customers in the United States. The company did not confirm whether a final decision has been made on increasing production as per the Bloomberg claim.

Regulatory approval in China is Still Pending

Despite strong interest from buyers, shipments to China are not yet guaranteed. Chinese authorities have not yet formally approved H200 imports, and officials are reportedly holding high-level meetings to assess the broader impact on the domestic semiconductor ecosystem.

China is pushing for greater self-reliance in AI hardware, and policymakers are considering whether increased access to foreign accelerators could slow the progress of local chipmakers. According to a proposal under discussion, companies importing H200 chips would also be required to purchase a certain portion of domestically produced processors. Why the H200 is in Demand

The H200 entered widespread use last year and is manufactured by TSMC using its 4-nanometer manufacturing process. Although it belongs to NVIDIA’s previous hopper generation, it offers significantly better performance than the China-specific H20 chip introduced in late 2023.

Analysts say the performance gap between the H200 and most domestic alternatives is significant, making it an attractive option for companies running large-scale AI models and data-intensive workloads.

Also Read: Best Laptops for Deep Learning, ML, and AI

Capacity Constraints May Limit Expansion

Even if regulatory approvals move forward, scaling up H200 production may be difficult. TSMC’s advanced fabrication capacity is already under pressure as numerous technology companies compete for access to leading-edge nodes. NVIDIA will also have to balance short-term demand against its long-term roadmap, based on Blackwell and Rubin.

For now, the company’s evaluation is ongoing, and final decisions are expected to depend on Chinese regulatory outcomes and NVIDIA’s ability to acquire additional manufacturing capacity without disrupting the launch of its next generation.

Source: Reuters