Acer has confirmed it will raise prices on several PC products starting February 20, citing higher memory and storage costs in a move that reflects mounting pressure across the global hardware supply chain. The adjustment signals that the ongoing DRAM and NAND flash pricing cycle is now directly impacting retail PC buyers.

In a post published on X (formerly Twitter) by Acer’s Predator Gaming Japan account, the company stated that pricing for PC products sold through its official online store would be revised beginning February 20, 2026. Purchases completed before February 19 will remain at current prices, giving customers a short window to avoid the increase. Acer has not disclosed the exact percentage adjustment or a detailed list of affected models.

The announcement confirms that the price hike will take effect on February 20, 2026, with purchases made before February 19 remaining unaffected. The implementation has been confirmed for Japan through Acer’s official store channels. The company attributed the move directly to rising DRAM and SSD procurement costs, though the precise percentage increase has not been revealed.

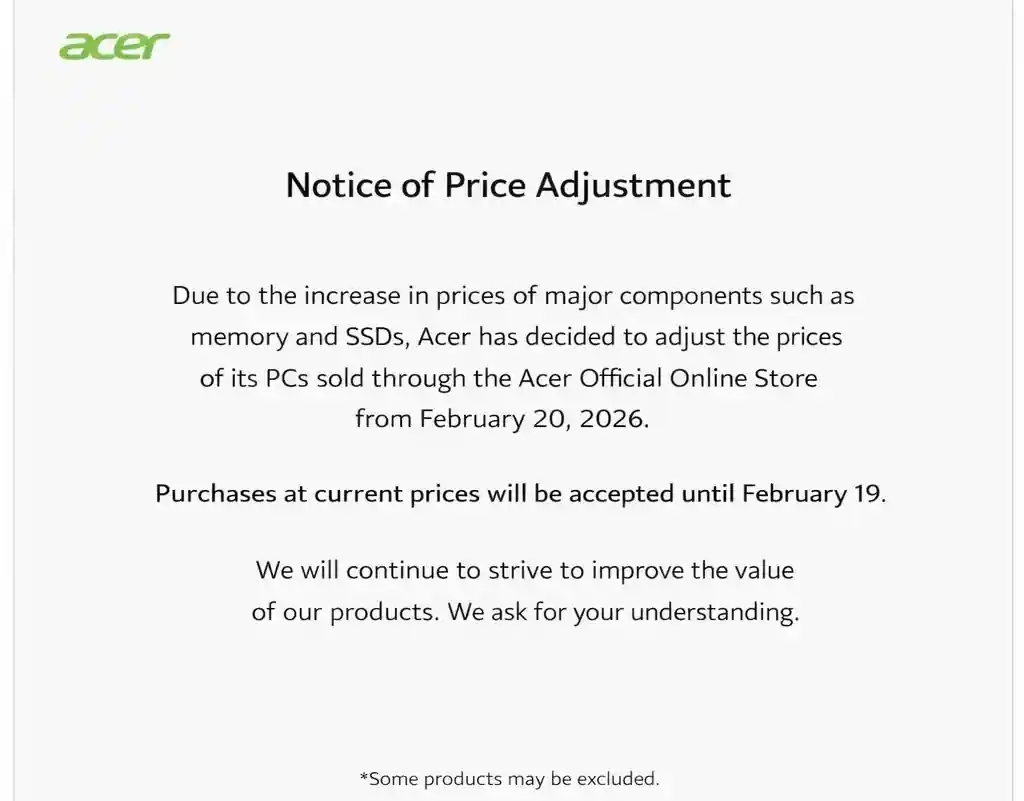

Notice of Price Adjustment

By Acer

Due to the increase in prices of major components such as memory and SSDs, Acer has decided to adjust the prices of its PC products sold through the Acer Official Online Store effective February 20, 2026.

Purchases at current prices will be accepted until February 19, 2026.

We will continue striving to enhance the value of our products. We appreciate your understanding.

Some product prices may be revised.

While the statement originated from Acer’s Japanese channel, memory and storage supply contracts operate globally, meaning similar adjustments in North America and Europe would be consistent with previous hardware pricing cycles if component costs remain elevated.

Acer directly pointed to rising memory and SSD costs as the primary driver behind the decision. Over the past two quarters, industry tracking data indicates that DRAM contract prices have climbed by high single digits to low double digits, while NAND flash pricing has rebounded following a prolonged downturn.

If those increases are passed through proportionally, midrange laptops could see retail price jumps in the range of $50 to $150, while high-performance gaming desktops and creator-class systems with larger RAM and SSD configurations could rise even further depending on specifications.

Modern performance laptops now frequently ship with 16GB or 32GB of memory as standard, compared to 8GB configurations just a few years ago. That structural shift significantly amplifies sensitivity to DRAM price swings. Even moderate contract increases can materially raise bill-of-material costs when higher baseline memory capacities are involved, particularly in gaming and AI-enabled systems.

This pricing cycle differs from previous memory spikes. During the 2017 DRAM surge, consumer PC pricing rose sharply due to constrained fabrication output and strong smartphone demand. Today’s environment introduces a new variable: artificial intelligence infrastructure. Data center operators and AI accelerator manufacturers are aggressively competing for advanced memory supply, including high-capacity DRAM modules and high-bandwidth memory.

As hyperscale cloud providers expand AI workloads, procurement pressure tightens availability across the broader semiconductor ecosystem. Even though consumer PCs typically do not use high-bandwidth memory, competition for fabrication capacity and advanced production nodes can indirectly influence mainstream DRAM and NAND pricing.

The result is a memory market increasingly influenced by AI-driven demand cycles rather than traditional PC or smartphone upgrade patterns. This shift suggests that component volatility may persist longer than in previous cycles, especially as AI infrastructure spending continues to accelerate globally.

Although Acer has not published a detailed list of affected products, systems with higher RAM capacities and larger solid-state drives are the most exposed to component inflation. Gaming laptops, pre-built gaming desktops, high-capacity productivity laptops, and creator-class systems are likely candidates for adjustment. Peripherals and accessories are less likely to be affected, as they are not directly tied to DRAM or NAND components.

Acer’s announcement aligns with a broader industry pattern in which several hardware manufacturers have signaled that 2026 pricing may reflect elevated component costs as AI-driven workloads reshape hardware requirements. While some vendors may attempt to absorb cost increases to maintain market share, sustained DRAM and NAND inflation ultimately compresses gross margins.

Passing some of the cost increase to customers helps companies protect their profit margins. The PC market has become very competitive, and average selling prices have been under pressure since demand slowed after the pandemic.

The timing is important because global PC demand is starting to stabilize after several slow years. Many businesses are upgrading their systems before major software changes. At the same time, more consumers are choosing AI-powered laptops designed for productivity and creative work. These systems usually need more memory, which makes them more affected by changes in DRAM and NAND prices.

For buyers, the February 20 price change creates a short window to purchase at current rates. Customers planning to buy gaming desktops, high-memory laptops, or other memory-heavy systems may save money by completing their purchase before the deadline in affected regions. Large enterprise buyers may also need to review their budgets if similar price adjustments expand beyond Japan.

Also Read: Best Acer Laptop

Looking ahead, the direction of memory prices will decide whether this is a temporary increase or part of a larger pricing shift. If DRAM and NAND production increases in the second half of 2026, prices may stabilize. However, if demand for AI infrastructure remains strong, memory costs could stay high into 2027, especially for high-capacity systems.

Acer’s move could be the first visible price adjustment in what may become a broader PC pricing shift in 2026. For years, component costs were relatively stable. Now, rising AI demand and limited memory supply are changing the economics of hardware. What starts as a regional price increase could signal a wider industry trend driven by growing investment in artificial intelligence infrastructure.